The German playwright, Bertolt Brecht wrote in the 1930s that it is easier to rob by setting up a bank than by holding up one. If Brecht were alive today, he might want to revise the statement by substituting pharmaceutical company for bank. Using a measure called Return on Invested Capital (ROIC), research shows that large drug companies were the most profitable industry, with a combined ROIC of 17.3%. The average ROIC across other industries was 11.5%. Thus in 2019 Pfizer (maker of Viagra) generated revenue of $52 billion; Roche (maker of Valium) made $48 billion.

Understandably, in the current climate, people are looking for cures and treatments for COVID-19. In mid-May, Donald Trump was touting his support for, and apparent taking of, the anti-malaria drug hydroxychloroquine as protection against the coronavirus despite federal regulators warning of its potentially serious, even fatal, dangers. Then came recent news that a cheap steroid called dexamethasone, a drug that’s been around since the 1960s, showed it could reduce deaths by up to one third in critically ill patients – the cost for 90 tablets is $22.50.

Gilead to the rescue?

At the beginning of July, Trump boasted that the US had bought the world’s entire supply of remdesivir, the antiviral drug produced by the US biotechnology company Gilead Sciences. Remdesivir shortens the time taken to recover from COVID-19. Canada will not be able to buy remdesivir or produce it for three months. At the same time, Gilead announced its pricing for remdesivir, saying it would charge $3,120 for patients with private health insurance. The amount that patients pay out of pocket depends on insurance, income and other factors. “We’re in uncharted territory with pricing a new medicine, a novel medicine, in a pandemic,” Gilead CEO Dan O’Day said in a statement. Whether it’s uncharted territory or not, you can be certain that Gilead is erring on the side of maximising profits when they finally decide on their prices.

“This is a high price for a drug that has not been shown to reduce mortality,” Dr. Steven Nissen of the Cleveland Clinic wrote. “Given the serious nature of the pandemic, I would prefer that the government take over production and distribute the drug for free. It was developed using significant taxpayer funding.” Peter Maybarduk, a lawyer at the consumer group Public Citizen, called the price “an outrage.” He added “Remdesivir should be in the public domain because the drug received at least $70 million in public funding toward its development.” The price puts to rest any notion that drug companies will “do the right thing” because it is a pandemic. $3,120 for a drug that can be produced and sold for a profit at $10 and it doesn’t even save lives!

Remdesivir – no orphan Annie

In mid-March, Gilead almost got away with making more money with the attempt to have the US government support its application to have remdesivir approved as an “orphan drug,” i.e., a pharmaceutical agent developed to treat medical conditions which, because they are so rare, would not be profitable to produce without government assistance. This designation is intended to encourage the development of drugs affecting fewer than 200,000 Americans by granting strengthened and extended legal monopoly rights to the manufacturer, along with waivers on taxes and government fees. At the time, remdesivir was a candidate for treating COVID-19 and there were fewer than 200,000 Americans infected. However, the number of infections was climbing rapidly and crossing the threshold was considered inevitable.

Remdesivir was developed by Gilead with over $79 million in US government funding. The consumer group Public Citizen and other health groups sent a letter to Gilead’s chief executive, Daniel O’Day, asking him to reverse course. “This is an unconscionable abuse of a program designed to incentivize research and development of treatments for rare diseases. Calling Covid-19 a rare disease mocks people’s suffering and exploits a loophole in the law to profiteer off a deadly pandemic.” Following these strong reactions, by the end of March, Gilead withdrew its application to have remdesivir designated as an orphan drug. Despite this, the company still retains 20-year remdesivir patents in more than 70 countries.

Gilead’s CEO Daniel O’Day (who received a $29 million pay package last year) cast the pricing scheme as an altruistic and selfless act on behalf of his company ($23 billion in revenue for 2019). “We approached this with the aim of helping as many patients as possible, as quickly as possible, and in the most responsible way,” said O’Day. “In making our decision on how to price remdesivir, we considered the full scope of our responsibilities. We started with our immediate responsibility to ensure price is in no way a hindrance to ensuring rapid and broad treatment.” It would be more accurate to say that, with government support, the path for Gilead to achieve a rapid and broad treatment for its “orphan” was by establishing a monopoly on distribution of the drug.

Gilead’s other dark history

Gilead has a less than stellar record particularly in the area of HIV/AIDS drug development. A coalition of HIV/AIDs activists estimates that fewer than 10% of at-risk individuals in the US receive Gilead’s drug, Truvada. Infection rates remain high (roughly 38,700 Americans became newly infected with HIV in 2016). Gilead sells Truvada at about $1,600 to $2,000 per month in the US while generic versions are available elsewhere for as little as $6 per month.

Several class-action lawsuits have been filed against Gilead over allegations that the company deliberately delayed development of antiretroviral drugs in order to maximize profits from previous-generation medications. In the interim period, many HIV patients who continuously took Gilead’s older drugs suffered permanent, debilitating kidney and bone damage.

Gilead has a stellar record for price gouging and avoiding taxes. A 12-week course of treatment for its hepatitis C drug Sovaldi, developed with help from US taxpayers, was set at $84,000 in the US, while the cost of making the course of drugs is under $1,400.

And in Canada? What chance for pharmacare?

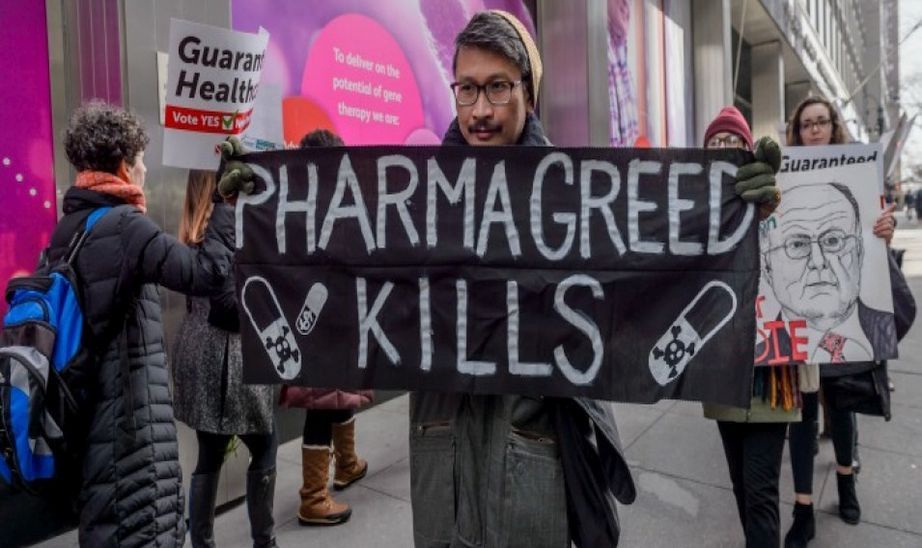

It would need a book to document all the wrongdoings of Big Pharma from price gouging to patent abuse and a lot more in between. It’s not just a US phenomenon. Regarding access to affordable medicines, Gilead and other companies are part of an industry that has deliberately created an American system that is set up to encourage price gouging. The major drug industry lobbying groups have millions at their disposal to fight off efforts to reinstate reasonable pricing rules and to allow Medicare to potentially save billions of dollars by negotiating lower prices for medicines. Here in Canada, both the Liberals and NDP have committed to some form of national pharmacare plan. Canada is the only country in the world with universal health care that does not provide universal coverage for prescription drugs.

Any plan would see the government involved in the bulk buying of medicines. Unsurprisingly, it’s a popular idea – 88% of Canadians support it. However, this doesn’t mean that the lobby groups for Big Pharma are going to roll over.

The government announced the tentative pharmacare proposal in its 2018 budget but it’s now likely that they will go slow on this, given the estimated cost of $28 billion to go ahead with it. No doubt, they will use the excuse of not wanting to worsen the government debt situation, arising from COVID-19. That will be music to the ears of the pharmaceutical and insurance industries who have already embarked on a lobbying frenzy in Ottawa. As reported in The Tyee, “No one knows exactly how much money Big Pharma, Big Insurance and billionaires are funnelling into the anti-pharmacare campaigns. No mechanism exists in Canada to ensure that level of transparency. However, it is possible to gather fragments of evidence that suggest a complex tapestry of lobbying and advertising activity being deployed by these actors to protect their interests.” And these pharma companies have a lot to protect – if you take into account the likely growth of profits looming on the horizon from high-cost medications.

We need a program to ensure that people and their health come before profits. Socialist Alternative demands:

- A national, universal and affordable pharmacare plan.

- Nationalization of the big pharmaceutical and private insurance companies.

- Production and distribution of medicines to be co-ordinated and integrated.

- Research and development of new drugs to be planned and integrated with academic research institutions. No more wasteful duplication.

- Tax the rich. A wealth tax to help finance the initial costs of implementing pharmacare.