Gas prices have soared around the world, adding to inflation that is hitting workers’ living standards. Vancouver, like its overinflated housing market, has Canada’s highest gas prices. The price of gas in Vancouver rose from $1.60 a litre in December 2021 to $2 a litre in March and over $2.30 in May. In most of Canada, from Ontario east, prices are over $2. Only on the prairies are prices well below $2. But even there, the prices have soared, up from around $1.25 a year ago to now heading to between $1.70 and $1.90.

Oil is a global commodity, so local factors — taxes, production costs, etc. — have only a marginal impact on the local price, although every summer, gasoline prices rise as people drive more for holidays.

West Texas intermediary is one of the global markers for oil prices. In December 2021, it was selling around $US72 a barrel. Following the Russian invasion of Ukraine in February, the price soared to $US120 a barrel and since then has fluctuated around $US105 a barrel. The cost of producing oil in Canada has not changed since February, but the price at the pump has skyrocketed.

Russia is the world’s largest gas exporter and second largest oil exporter. The International Energy Agency says that Russia’s oil and natural gas revenues make up 45 percent of Russia’s federal budget. Russia’s revenue from oil and gas is largely funding its war on Ukraine. The European Union is considering banning Russian oil, which would add to price instability. A decision to boycott Russian oil and gas would result in a major supply problem and price shock in Europe.

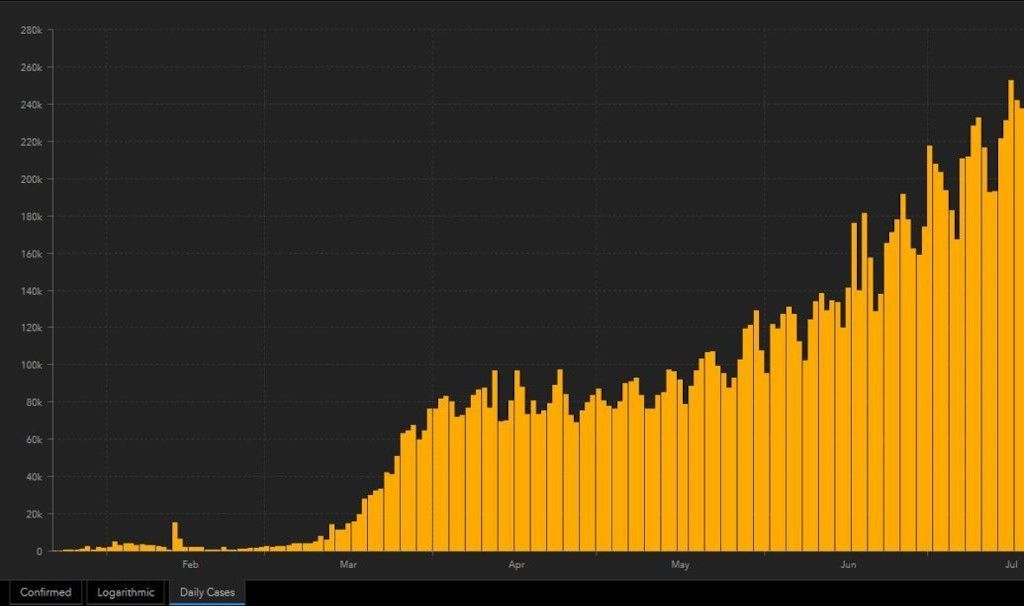

Prices may rise even higher. China is the world’s second largest oil consumer after the United States. Once major Chinese cities emerge from their latest COVID lockdowns, the Chinese government could attempt to kickstart the economy, which would drive oil prices even higher.

While geo-political factors have driven this increase, at the heart of it all is one singular factor: capitalism and the greed for profit.

Over the last two years, as the world went through one catastrophe after another, the oil and gas industry witnessed record profits in 2021. Canadian Natural Resources collected record profits of $7.7 billion profit, and Suncor hit $4 billion. Suncor’s profits soared even higher in the start of 2022: its profits for the first three months of the year hit nearly $3 billion, triple that of a year ago. In Europe, British Petroleum made $6.2 billion in profits for the first three months of 2022, compared to $2.6 billion in the same period last year. Shell had its highest ever quarterly profits, making $9.13 billion between January and March 2022.

Those are not simply your run-of-the-mill profits. These are windfall profits, characterized by ridiculously high numbers and lucky circumstances that are out of the ordinary even by capitalism’s ridiculous standards.

In Canada, and most of the world, the increase in the price of oil, gasoline and other oil-based products are not due to increased production costs. The oil companies are profiteering from war and misery and adding to the economic woes of people across Canada and the world. The increase in fuel prices will boost the cost of growing and harvesting food — prices are already up due to war, droughts and floods. Wheat prices, for example, are up two-thirds from six months ago. The increase in oil prices will impact almost everything as transport costs will rise.

The government could order companies to stop gouging and cut prices. This seems unlikely for the Liberals, who are friends of Bay Street, and unlikely to be supported by the Tories, who are in love with big oil companies. Maybe a windfall tax on the huge profits, which could be used to help workers pay the soaring costs.

Windfall taxes are not a new concept. Trudeau’s government has imposed a one-off windfall tax of 15 percent of profits on the banking industry. The British Tories in 1981 introduced a windfall tax on banks! In 1997, the British Labour government taxed companies that had been privatized since 1979 as they had been undervalued at privatization. The tax was calculated based on the difference between the price at which they were privatized, and the market valuation in the four years after their sale. Unlike fuel tax cuts that primarily benefit the ruling class, a windfall profit tax would allow for revenues to flow directly to low- and middle-income households that are at the receiving end of price hikes. As Canada’s banks have been taxed at 15 percent, the same tax should be immediately applied to oil and gas companies.

However, a windfall tax only modestly hits the profit-gouging oil companies. It doesn’t stop them doing it again or continuing to pollute the planet. The socialist answer is publicly owned and democratically controlled utilities that function for the benefit of the working class and the planet. Then the huge wealth of these companies could be used to transition to clean energy and provide good jobs.

This would be an important part of overthrowing capitalism and opening the way to a society that cares for people and nurtures the environment.