Peter Taaffe is a member of the Socialist Party (CWI in England & Wales).

Six years after the financial crash and economic slump, the world capitalist economy appears to be sliding towards a new downturn. The US is struggling through a feeble ‘recovery’. Germany and the eurozone seem to be edging towards a third recession. Japan is also recession bound. Russia is being battered by falling oil revenues and sanctions over Ukraine. China, India and other ‘emerging markets’ are slowing down sharply. Capitalist leaders are in disarray: they have no solutions for the protracted crisis. Analysing the present conjuncture, we are carrying here an extract from the November draft statement of the International Executive of the Committee for a Workers’ International.

Prospects are worsening in virtually every sphere of the world economy. Uncertainty deepens with each passing day, as capitalist economic institutions and their spokespersons announce ‘disappointing’ figures for growth. The eurozone, the world’s second-biggest economic area, is in retreat from even its recent feeble recovery. Germany, its economic powerhouse, is currently stagnating, coming close to outright recession. Its continued dependence on exports means that German capitalism is vulnerable to sudden shocks. Japan, the world’s third-biggest economy, is on the edge of a downturn. Added to this is the dramatic 20% plunge in the oil price, a key economic indicator which will also affect geopolitical developments.

The rapid development of oil from the ‘shale revolution’, in the US in particular, is one of the factors driving down the world price of oil. US oil production is up by 80% since 2008, an additional four million barrels of oil annually. This has been a key factor in the limited US economic recovery, generating an estimated extra two million jobs. In 2012 the OPEC oil price stood at more than $110. It is estimated that, if it fell to $80 for a year, US motorists would have an extra $160 billion in their pockets which, the Financial Times said, “is equivalent to a sizeable tax cut” – without having to clear Congress!

Japan, however, is entirely dependent on foreign oil and China imports 60% of its needs and could see gains from lower fuel prices. Other countries have been affected adversely: 40% of Russia’s state budget income is oil revenue. Lower oil prices complicate the country’s economic difficulties, already affected by the sanctions imposed following developments in Ukraine. Saudi Arabia could also be severely affected over time, which in turn could trigger political upheavals. The Saudi regime has accumulated massive reserves estimated at $747 billion, more than three years of spending. But if oil stays at $80 a barrel for a year this will considerably eat into these. For Nigeria, which depends on oil and natural gas exports for around 80% of revenues, the falling oil price is a disaster. Its foreign reserves are even smaller now than they were at the time of the 2008 oil price crash ($37.8bn compared with $53bn) and the government has started to warn of tougher times ahead. Other oil producers, including in Latin America, could also be seriously affected.

It is the overall economic prospects of world capitalism that are mainly responsible for the drop in the price of oil and the extremely gloomy prognostications of the capitalist institutions which flow from this. The IMF has cut its estimate of global growth this year from 3.4% to a little over 3%, yet as recently as April it was expecting a 3.6% increase. A similar downgrade exists for the ‘emerging markets’. Brazil and Russia remain ‘in torpor’. The only supposed bright spot is India, which nevertheless has slashed growth-rate expectations! These countries have to adapt to the end of the ‘commodities boom’. Favourable conditions for commodity producers are unlikely to return quickly. China, a huge commodity market, is now calculated to have overtaken the US as the largest economy in the world but it, too, is slowing down.

The IMF’s chief, Christine Lagarde, has warned of a “new mediocre era of low growth for a long time”. This completely confirms the economic analysis of the CWI: that capitalism displayed ‘depressionary tendencies’ even before 2008 and is now, in some regions at least, experiencing an outright ‘depression’. Martin Wolf of the Financial Times writes that the best capitalism can hope for is what he calls a “managed depression”. Larry Summers, former US treasury secretary, has recalled the phrase “secular stagnation”, first used in the 1930s.

The scaled-down expectations of the capitalists are reflected by the fact that only Britain and the US in the advanced capitalist world can be pointed to as ‘models’ to be followed: “The US and the UK in particular are leaving the crisis behind and achieving decent growth”! In crude figures this may appear to be the case but the reality is that this is at the expense of the working class, with its share of national income falling severely. Workers are experiencing a ‘joyless boom’.

Wages have consistently lagged behind the rise in the cost of living, with British workers losing at least 10% of their share in wages in the last ten years. The gap between rich and poor has grown massively, with poverty now at a level not seen in Britain since the 19th century. Moreover, the jobs which have been created are very low paid, often part-time, ‘Mickey Mouse’, ‘self-employed’ jobs, many of which soon fold because of the lack of a market. Average wages are completely insufficient to maintain living standards, let alone improve them. This has fuelled our campaign in Britain for a minimum wage increase to £10 an hour, which has received great support from workers and youth, and is now the official policy of the Trades Union Congress. The great success of our comrades in the US with the ‘15 Now’ campaign – which has been taken up by workers throughout the US – has undoubtedly had a big effect on workers everywhere, particularly in Britain.

Weak US growth

As far as the US is concerned, the official figures do not reflect the real situation, with deteriorating living conditions for huge swathes of the US population. Moreover, the numbers working in the US have not returned to the level of the pre-recession period before 2008. Many workers have just dropped out of the labour force.

Inequality began to widen more than two decades ago in the US. However, general growth and an ability to borrow helped to cover this up for considerable sections of the population. During Ronald Reagan’s first six years in office (1981-86), GDP grew by 22% while median income grew 6%. During Bill Clinton’s first six years (1993-98), GDP grew by 24%, median income 11%. Growth began to slow from 2000, undermining both the mean and median figures. In George W Bush’s first six years, GDP rose by 16%, but median incomes fell by 2%. Under Barack Obama, it has been even worse: GDP is up 8%, and median income is down 4%, according to the Census Bureau.

The current ‘impressive decline’ in unemployment partly came about because many people just gave up looking for work, and so are not counted as unemployed. The gap between income and expenditure was also covered before the recession, partly by borrowing on the basis of rising house prices. Following the collapse of the housing bubble, household income began to drop. Any growth up to the 2008 crash was mostly debt-fuelled.

The same goes for any growth that has taken place in the six years since the crash of 2008. The total burden of world debt – private and public – has risen from 160% of national income in 2001 to almost 215% in 2013. In other words, contrary to widely held beliefs, the world has not begun to de-leverage and the global debt-to-GDP ratio is still growing, breaking new heights. One of the authors of the annual Geneva Report commissioned by the International Centre for Monetary and Banking Studies, Luigi Buttiglione, the head of global strategy at hedge fund Brevan Howard, said: “Over my career I have seen many so-called miracle economies – Italy in the 1960s, Japan, the Asian tigers, Ireland, Spain and now perhaps China – and they all ended after a build-up of debt”.

In an upswing, carefully controlled credit can lubricate the system, leading to a spiral of growth. But the massive borrowing which took place during the upswing in the US and worldwide continued during the crisis. This was because of the fear of complete economic collapse and what this would mean for the political consciousness of the working class and its growing opposition to the system. The injection of credit has been astronomical. The US Federal Reserve bought $4.5 trillion of assets, the Bank of England, £375 billion so far, and the Japan Central Bank will have bought over $1.5 trillion of assets by April 2015.

It was the overall ‘lack of confidence’ that led to the meltdown in stocks and shares in October 2014, which developed at considerable speed as well as spreading to most parts of the world. There were many underlying factors which sparked it off. Perhaps the main one was the promised withdrawal by the US Federal Reserve of the quantitative easing programme that cost over $3,600 billion. That was the main factor in leading to a stampede out of stocks and shares, which has now raised starkly the possibility of a repeat of 2008, only worse.

Like drug addicts, the capitalist world has got used to massive injections of liquidity. The economic theorists of the system are not sure what effect quantitative easing has. The former US Federal Reserve chairman, Ben Bernanke, in answer to whether QE was working, joked: “The problem with QE is it works in practice but it doesn’t work in theory”! In reality, this monetary measure has only worked partially in theory but hardly in practice. Nonetheless, the mere threat to phase it out partially – with no real alternative other than the continuation of failed austerity programmes – resulted in panic stations.

The choice for capitalism seems to be reduced to either further debt-fuelled growth, including the perpetuation of low interest rates, with the danger of inflation further down the road, or the maintenance of savage austerity. At the same time, some capitalist economists have concluded that the massive growth of inequality over the last 15 years ‘beyond a certain point’ is bad for the system. The huge growth in the share going to CEOs of companies and the relentless pushing down of wages seriously repress ‘demand’.

The Bundesbank has even suggested that German trade unions should fight for wage increases, which they would support! However, this policy is not intended to apply to the rest of Europe, which must be kept on ‘rations’. Even rotten German social democracy, in coalition with Angela Merkel’s Christian Democrats, has ruled out any significant shift in economic policy, particularly throughout the rest of Europe.

But another section of the capitalists is now afraid that they will be trapped in a Bermuda Triangle of endless austerity. This threatens to provoke a new crisis and a revolt of the working class. There are no easy options on the table. However, the maintenance of high global debts, despite the efforts of different governments to reduce them, is provoking a new combination of spiralling debts and low growth that could trigger another financial crisis. The bourgeoisie swings from optimism to deep pessimism.

Slowdown in China

Since 2007, the ratio of total debt, excluding the financial sector, has jumped in China to 261% of GDP. Martin Wolf states: “One can debate whether this level is sustainable. One cannot debate whether such a rapid rate of rise is sustainable; it cannot possibly be so. The rise in debt has to halt with possibly significantly more adverse effects on China’s rate of growth than today’s consensus expects”.

The world recession has had a significant effect on China. Following 2008, the Beijing regime managed to maintain a quite startling rate of growth in the economy. It was not on the previous scale, but was still one of the largest, if not the largest, growth rate in the world. It has led the pack and, economically, pulled other countries along with its demand for their resources. Now, the downturn has had big consequences, with the resource-rich countries like Australia and Brazil facing a contraction as China slows.

By any standards, China has risen remarkably over a significant historical era. It was the world’s largest economy in 1820, with an estimated 33% of global GDP, but over the course of a century and a half, the economy shrank to around 5% of world GDP before starting its recovery in 1979. Recent reports indicate that China has now become the largest economy in the world, although some authoritative institutions still say that it will arrive at this point later. From 1979 to 2012, the annual GDP growth of China averaged nearly 10%, which enabled China to double the size of its economy in real terms every eight years.

At the present rate, it is estimated that China’s share of world GDP will increase by 5% per decade. At a roughly equivalent stage as China today, in the first half of the 20th century, the US averaged 2.5% growth. At the height of its power, in the 19th century, British capitalism increased by 1% per annum. However, China’s per capita income will not reach the west’s soon. Using purchasing power parity, China’s GDP per capita was roughly $9,500 dollars, just 18.9% of the US level. It is expected that it will only grow to 32.8% of the US level by 2030. Moreover, China faces a big demographic problem with its population already beginning to age and the pensions pick-up will rise as we go further into the century.

Growth gradually slows down under the best scenario. But something worse could happen if the economy goes into complete meltdown on the basis of China’s evolution from a form of state capitalism to an increasingly ‘normal’ neoliberal model. The Chinese Communist Party’s third plenum in November 2013 called for a more ‘decisive’ market role, while stressing the continuing importance of the ‘public sector’. However, we have heard this song before. Plans were formulated for large-scale privatization only for the regime to draw back because of the fear of mass unemployment and the social consequences. Many of the so-called princelings are deeply enmeshed in lavish corruption with state banks and state-owned enterprises. Nonetheless, it is clear that the direction of travel is towards further and further privatizations with all the consequences that flow from this.

In the short term, China could be heading for a serious crisis. It already has a massive debt-to-GDP ratio problem which has risen from 48% in 2008 to 261% today. We must be ready for convulsions in China, which by definition will be a world event. At the same time, India’s growth rate has halved to 5%.

A parasitic system

The present situation indicates a frozen system symbolized by a ‘paradox of thrift’, mentioned by Keynes, with corporate ‘savings’ dramatically rising throughout the world, partly because bosses feel a greater need to protect themselves against the free market turmoil. There is also little opportunity for capitalist productive investment, which results in massive corporate cash hoards amounting to 44% of GDP in Japan, 34% of GDP in South Korea and similar piles in other parts of East Asia. The same inexorable pattern of rising cash hoards, while wages stagnate or fall, is evident elsewhere.

So dangerous is the situation that we are informed that the British and US central banks have conducted financial tests – ‘war games’ – about how they would handle another Lehman Brothers-style banking crisis! This reinforces the idea that further events along the lines of 2008 and worse are being seriously considered by the financial institutions, with the aim of trying to put in place preventative measures to stop them happening, or at least rescue measures the financial institutions need to take.

The parasitism of ‘modern’ capitalism is revealed by the process of company buybacks of their own shares. Even the financial press has denounced this as “corporate cocaine”, and it continues to increase. Record profits have been accumulated on a massive scale and buybacks have increased partly because, currently, there is no profitable outlet, but also because it piles up the wealth of the capitalists, particularly of the CEOs. This adds to eye-watering inequality as well as boosting share prices. This in turn leads to a drop in investment, which signifies a lack of confidence of the capitalists in their own system.

Stanley Fischer, the vice-chairman of the US Federal Reserve, warned in August about a “permanent down shift in the potential of powerhouses such as the US, Europe and China”. This is one more indication that the economic soothsayers of capitalism are beginning to catch up with the analysis that we have made since the beginning of the 2008 crisis. He goes on to state that “the falling rate of productivity and labour force participation in the US, among other factors, may have scared the country’s ability to generate economic growth”.

Such openly pessimistic conclusions for the future of US capitalism – and, by implication, world capitalism – have become more and more common as the working class as well as big sections of the middle class are beginning to draw their own conclusions: “They lay bare a crisis of faith in the global elite”. (New York Times) This organ of US capitalism concludes: “There has been an implicit agreement in modern democracies: it is fine for the wealthy and powerful to enjoy private jets and outlandishly expensive homes so long as the mass of people also see steadily rising standards of living. Only the first part of that bargain has been met, and voters are expressing their frustration in ways that vary depending on the country but that have in common a sense that the established order isn’t serving them”. Falling living standards and rising inequality have big political implications, both for the mood and consciousness of the US and world working classes.

The long-term health of the capitalist system is increasingly called into question by the growth of technology. (See: A ‘Third Industrial Revolution’, Socialism Today No.183, November 2014). In some industries, the introduction of automation will be a ‘jobs killer’. Robert Gordon, the US economist, estimates that 47% of US jobs are threatened from this quarter. Some, including the Economist magazine, overestimate the ability of capitalism to find new markets, and have a utopian perspective of how this issue can be harnessed to the benefit of all within the framework of capitalism.

Yet even the ‘sober’ Economist warned about the future of capitalism, becoming “wealth without workers, workers without wealth”. It emphasized: “Wealth creation in the digital era, has so far generated little employment. Entrepreneurs can turn their ideas into firms with huge valuations and hardly any staff… a maker of virtual-reality headsets with 75 employees, was bought by Facebook earlier this year for $2 billion. With fewer than 50,000 workers each, the giants of the modern tech economy such as Google and Facebook are a small fraction of the size of the 20th century’s industrial behemoths”.

This also widens the gulf of inequality between nations: “In 1820 the world’s richest country – Britain – was about five times richer than the average poor nation. Now America is about 25 times wealthier than the average poor country”. These astonishing trends point to the conclusion that an unprecedented era of conflict – an intensification of the class struggle – is beckoning, both within nations and on a world scale. The US will be an epicentre of the struggle. The convulsions there will, therefore, be greater, with colossal ramifications for the class struggle and therefore for opportunities for the growth of powerful socialist parties.

Europe’s dim prospects

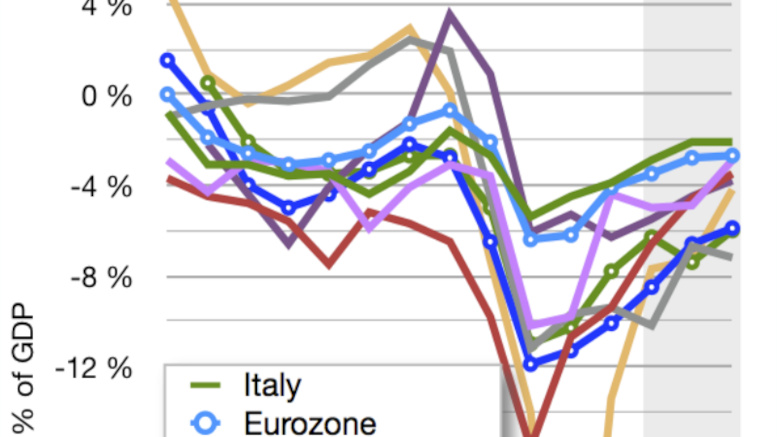

Economically, Europe remains mired in depression, which threatens to worsen in the next period. Unemployment in the eurozone stands at 11.5%, with an estimated 18.3 million job seekers without work. Italy saw unemployment among young people (15-24) rising to a fresh high of 44.2%. There is undoubtedly an explosive mood in Italy – as in southern Europe generally – which can spill over into big movements on the streets.

Now there is a sudden worsening of the economic position of Germany, which will have a continental effect. Its economy is becoming unstable. Industrial production fell 3.1% in August and 0.3% in September. Overall, Germany’s economy dropped by 0.1% in the second quarter and then grew by 0.1% in the third. However, a drop into recession is possible. In the teeth of the world recession, Germany was able to sustain its position at the expense of the rest of Europe.

With barely contained glee, the Financial Times states that Germany’s “growth model has helped to drain demand from the rest of the eurozone, unnecessarily denied German workers and households a higher standard of living, and left it vulnerable to external shocks”. It means that Germany was too reliant on exports, which are now severely affected by the world recession. Exports dropped by 5.8% in August, but grew in September. German capitalism received a competitive edge because of the “holding down of wages… [which] have fallen since 2000, suppressing consumption growth. It is particularly unhelpful, as other eurozone countries struggle to rebalance their economies, for German companies to snap up any export demand on offer”.

Additionally, German investment has fallen five percentage points as a share of GDP since 2000 and labour productivity per hour has grown less than 1% a year since 2005. Germany’s rivals are seizing on this opportunity to pile on the pressure – demanding that they carry through deregulation, as they demanded this of others: “Their own glass house could also do with some structural adjustment”. (Financial Times)

As the prospects dim for Europe emerging out of recession, the market stagnates and may even decline. So too with the euro itself, which has fallen to a two-year low. Consequently, capitalist-imperialist antagonisms within Europe have intensified. This manifests itself in the growing antagonism between those like France, Spain, Italy, etc, who wish for a loosening of the euro’s monetary constraints, and German capitalism and the core countries around it. The calculation is that, if the budgetary constraints were loosened to allow a deficit of more than 3% of GDP, this would generate ‘demand’ and, together with other measures such as quantitative easing, would show a way out, at least temporarily. The European financial authorities calculate that this would have a chance of avoiding the dreaded deflation if the ECB stepped in to purchase private-sector assets on a sufficient scale – involving expenditure up to €1 trillion.

Problems pile up

Yet all the ingredients remain for the collapse of the euro, despite reassurances that, unlike in 2012, the danger has passed. It hasn’t! Colossal pressures are building up on national governments, particularly through permanent levels of high unemployment, while the IMF has said that there is a good chance of a sudden euro collapse. As the problems pile up, investors and capital are beginning to flee Europe. The continent’s weaknesses are beginning to act as a drag on the world economy.

On a European level the problems are intractable under the present financial settlement and are accumulating. Such are the disparities now between ‘northern’ Europe and the south, it will be increasingly difficult for the governments of the latter to maintain the euro, which is a pernicious form of internal devaluation. It is likely that some kind of break will be initiated by southern Europe, although it cannot be excluded that Germany or some other north European country, or even Italy or France, will take the initiative to break from the euro. That would be followed by others.

In France, the government has already announced that the budget deficit will be at least 4.4%, well in excess of the 3% limit. Public expenditure amounts to 55% of GDP. This is a reflection of the past gains of the French workers, many of which they still retain. Up to now, both ‘left’ and right-wing governments have nibbled at these but have not taken the axe to them. The present right-wing prime minister, Manuel Valls, who comes from the extreme right of the Socialist Party, has been compelled to assure the working class that the 35-hour week remains ‘sacrosanct’.

It is highly unlikely that his assurances will be kept. If the government remains intransigent, it will face a media firestorm, with more threats from big business to relocate outside the country. The only way to withstand this pressure will be to appeal to the working class, carry out a radical program and prevent capital fleeing the country, through state control of all incomings and outgoings. This is only possible through the nationalization of the banks in the finance sector.

The ECB and the European Commission may still act carefully in regard to France and ‘kick the can further down the road’. However, this cannot continue indefinitely – this road is finite. If it goes on too long the ‘rules’ will become meaningless and the whole ‘project’ will collapse. François Hollande’s presidency is in deep trouble. In Italy, prime minister Matteo Renzi is approaching a head-on collision with the Italian working class, which is already moving from below as the strikes and demonstrations in Genoa last year, October’s mass protest in Rome, and the recent call for a general strike action from the CGIL, all indicate.

The economic crisis unfolds against the background of an unprecedented world geopolitical crisis with armed conflicts in the Middle East, increased tensions between the US and Russia, the Ebola epidemic, etc. At the same time, struggles during the last year or so – the mass movement in Brazil, the $15 hour movement in the US, the struggle for democratic rights in Hong Kong – point forwards to bigger struggles to come. The CWI can play a vital role in helping to rebuild and politically rearm the workers’ movement as a key part of the work to forge a force that can transform the world.