In the midst of the COVID-19 crisis, governments appear to be scrambling to come to Canadians’ rescue and to keep the economy from nose-diving into an abyss. But where are the billions of dollars in public funds that are being thrown at the COVID-19 crisis actually landing?

Trudeau announced an aid package to help Canadians weather the Coronavirus crisis in mid-March. The $107 billion bill passed on March 25 and people should be seeing the effect of this aid package starting April 6. What does this aid package include?

Who will benefit? Of the $107 billion, less than half ($52 billion) was announced for the Canada Emergency Response Benefit (CERB) meant to directly support those who are affected by the COVID-19 crisis. The other, larger half is $55 billion in tax deferrals for Canadian businesses. The bulk of this capital injection into the economy will be soaked up by big corporations and banks. In other words, some help for Canadians and lots of help for big companies.

On April 1, Trudeau announced $71 billion in wage subsidies, reducing the estimated cost of CERB to $24 billion. The wage subsidy, originally set at 10% of wages for small businesses, is now 75% for businesses, charities and non-profits of all sizes.

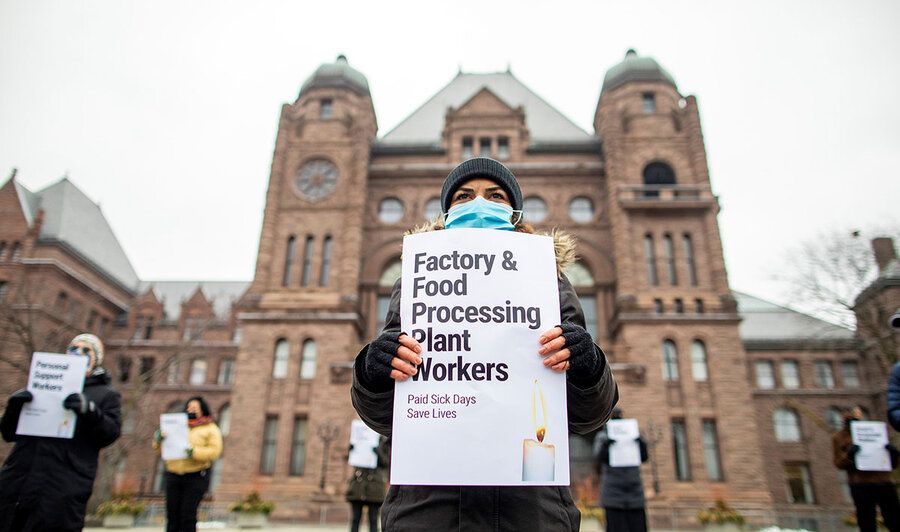

These wage subsidies will benefit businesses much more than workers. If social distancing is key to flattening the curve, why is the government encouraging businesses to take on more staff and remain open for longer hours? Are there any guarantees that businesses will provide personal protective equipment or full-time employment so additional workers qualify for benefits? Of course, workers and small companies need their paycheques to survive, but these subsidies will be providing heavily discounted labour for essential businesses, including multinational corporations, that are already remaining open and making profits.

Added to the wage subsidy, and being rolled out with less heroic fanfare, is the Canadian government’s second bank bailout in 12 years. In an attempt to stave-off a deep COVID-19 sparked financial crisis, the Canada Mortgage and Housing Corporation (CMHC) is expanding the number of insured mortgages it is willing to buy from banks. The CMHC is a publicly owned Crown Corporation, which safeguards the vast majority of Canada’s housing market by insuring mortgages. The CMHC announced on March 26 that it was willing to buy up to $150 billion worth of loans from Canadian banks (up from $50 billion). The aim is to help banks free up cash that can then be lent out to consumers and businesses struggling under the COVID-19 pandemic.

How generous! To put $150 billion into perspective, it is equivalent to giving $3,990 to every woman, man and child in Canada. Surely, the banks will pay this taxpayer-funded kindness forward in this time of need.

Well, on March 17, Canada’s six big banks (BMO, CIBC, National Bank of Canada, RBC, Scotiabank and TD Bank) announced that they would be supporting clients by allowing them to defer their mortgage payments for up to six months. Great!

Unfortunately, as the CBC has reported, “the fine print of those programs make it so that the deferred interest must be paid back at some point, which makes the loan longer and more expensive.” The interest added onto the end of the mortgage is also charged compound interest, so mortgage holders will be paying for the banks’ “solidarity” in this time of need. Lastly, despite the Bank of Canada interest rate cuts, Canadian banks have been hiking mortgage interest rates as they hunt for liquidity. Home-buyers know that they are getting a raw deal, but they are in desperate need of relief, with Bloomberg reporting close to 500,000 requests for mortgage payment relief as of April 3.

There is a deeper issue here. Canada’s entire banking system has been kept alive with easy credit and a giant speculative housing market bubble. Maybe the banks do need more liquidity, but that’s because they’ve been huffing the gas from this housing bubble and peddling easy credit to make it happen. This is yet another reason why Canada needs a massive affordable, green, public housing construction program. The housing bubble is inflating prices and rents, keeping many Canadians poor. On other hand, if the bubble bursts it will create a whole new set of problems for many who just wanted a stable home.

In the meantime, the federal government is encouraging banks to take action to alleviate the burden of high credit card interest for Canadians rather than legislating lower rates of interest on credit cards. In fact, the Prime Minister’s Office said that the government is not calling for cuts to existing credit-card rates. Unsurprisingly, even armed with a $150 billion gift, timid Trudeau doesn’t have the intent of stepping on banks’ toes.

One thing is clear, the government’s aid package will prevent hundreds of thousands of Canadians from starving in the coming months. But these same Canadians will emerge from this crisis with greater debt and financial disaster when all their payment deferrals expire. Even before COVID-19, nearly half of Canadians (48%) were $200 or less away from financial insolvency, according to an October 2019 Ipsos poll.

“We’re in this together,” says Trudeau, but Canada’s corporations and banks are set to make fat piles of cash off this latest crisis.