In early 2020, COVID engulfed Canadians and the world in turmoil that has not ended. War in the Ukraine, convoy in Ottawa, inflation everywhere, and fear of a banking crisis and another recession.

In June 2022, inflation was above 8 percent, the highest rate in over 40 years. It has declined to 5 percent, but prices are still going up. Prices in grocery stores are increasing by more than 10 percent a year. Rents are soaring. Average rent for new leases is up over 10 percent and much worse in Metro Vancouver, Toronto and Calgary, at around 20 percent. While house prices have dropped slightly, the cost of buying a house is up due to higher interest rates.

The only response to inflation is the Bank of Canada, along with central banks around the world, pushing up interest rates. This increases the squeeze on workers’ living standards as it increases debt charges, mortgages and rents. The theory behind raising interest rates is to reduce demand and eventually it is hoped prices will stop rising. Historically, this only works when it causes a recession.

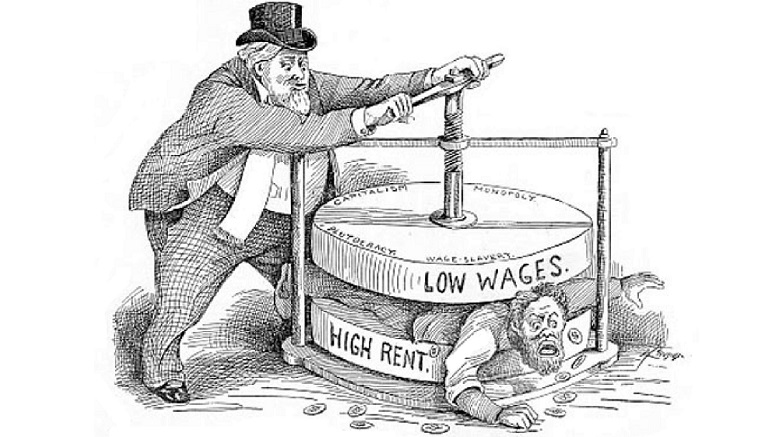

Either way, with higher interest rates or more unemployment, and possibly both, big business wants workers to pay for the crisis that they did not cause.

A Look at Inflation

It is absolutely clear that wages have not caused inflation. Wages in Canada are going up slower than the cost of living, so workers are becoming worse off. The bosses and the Bank of Canada blame workers’ wages to justify cutting living standards.

The last three years brought together several factors that combined to push up prices and caused the cost-of-living crisis. COVID disrupted production and delivery systems, so there were shortages of goods and parts. A worldwide shortage of microchips, that are used in everything, hit production of many goods such as cars and household appliances.

The war in Ukraine pushed up the global price of oil, which in turn increased the cost of making and delivering many products. It also disrupted food supplies as Ukraine is a major producer of grain and sunflower oil. Climate change continues to disrupt and lower food production, and floods and fires also impact other parts of the economy.

The years of easy money with ultra-low interest rates and central banks providing billions of dollars to big business fed speculative bubbles on the stock market, bitcoin, etc. Most do not directly impact ordinary people, but speculation is a factor pushing up housing prices in Canada and around the world.

Many corporations took advantage of rising prices to boost profits. Oil companies and big grocery stores had a record year for profits in 2022. These companies are profiting from people’s misery.

Raising interest rates does not tackle the main causes of inflation and there are reasons that inflation may be continue longer than is claimed. The war in Ukraine drags on and climate change is getting worse. Supply chains continue to be disrupted as companies move production out of China to other “friendly” countries, as part of the deep-seated conflict between the US and China.

Governments could act. They could stop corporations from raising prices and hold down profits or tax super profits and use the funds to help the low-paid. They could raise wages of their workers in line with the cost of living, they could start investing in infrastructure and force corporations to invest in training to overcome supply chain bottlenecks and claimed skill shortages. All of these would hurt the super-rich and big business, so of course neither the Liberals nor the Conservatives will do that.

The collapse of several banks in the US and Switzerland is a warning of problems ahead. The 2008 recession started with a financial crisis. The global banking system is full of speculative bubbles from the easy money years that may well burst and hit real people just as happened in 2008-09.

In early 2023, unemployment was low, and the economy was growing, giving rise to hopes of no recession. However, there are many warning lights. The Bank of Canada may well push interest rates higher as inflation continues. This will hit the construction industry, already starting to slow, which is a major driver of jobs and economy. Canadians’ increasing debt burden will reduce spending, which will reduce employment. A major shock to the world economy could rapidly push Canada into a recession.

The Housing Nightmare

Canada had a housing crisis before inflation, and the Bank of Canada has made it worse. Housing costs, along with food, are now the fastest rising items in workers’ budgets. As higher interest rates increase mortgages costs, the Bank of Canada’s housing affordability index is at the worst level in years. Homeowners used 62.7 percent of their income to cover their housing costs. No wonder Canadians are drowning in debt, standing at 180 percent of income. Bankruptcy and home foreclosures are going to get worse.

Rents are soaring as people who can’t afford to buy are renting. Faced with high demand, landlords are pushing up rent as fast as they are allowed. In some provinces there are no rent controls and even in the provinces with controls, these are very weak.

Canada has a shortage of affordable, publicly owned, rental homes. Building of public rental units almost ceased after the federal Liberals slashed spending on social housing in the 1990s. If these programs had continued there would be some 700,000 additional affordable rental units.

Big landlords with deep pockets are taking advantage of higher mortgages to buy up housing. Investors own 40 percent of condos in Ontario, 36.2 percent in BC and 36.6 percent in Nova Scotia. There are many reports of investors buying a rental property, evicting the present tenants, and pushing up rents by 60 or 70 percent. Investors want to make money.

Canada urgently needs strong rent controls to stop landlords jacking up rents, and a national housing strategy focussed on building good quality, publicly-owned rental units. Housing policies, where they exist, concentrate on “encouraging” private developers with grants and loans, and plans to cut regulations. Reliance on the market caused the housing crisis. The market is about making money so it will not provide affordable housing for working people. It will continue doing what is profitable, whether that is tearing down older affordable rental buildings to build luxury units or evicting tenants and jacking up the rent.

Political Inaction

Politicians are doing little about the cost-of-living crisis, offering a few hundred dollars to compensate for soaring prices, but not taking action to rein in the price of food or housing.

The Liberals are increasingly out of touch. Poilievre makes a lot of noise, but his solution is to cut public services, which will make things worse for most people. However, given the Liberals’ failure, his pretence of caring for working people is winning the Conservatives more support.

Unfortunately, the NDP is not campaigning on a bold program in the interests of workers. Instead, it tags along behind the Liberals, occasionally barking for something. The Liberals throw the NDP a modest bone, such as improving dental care, but no progress on the much-needed and long-promised public pharmacare.

The main unions have not launched a united campaign to win Cost of Living Adjustments. Both in Ontario and BC, the public sector unions wasted the possibility of a united struggle, instead settling for wages that cut living standards.

Socialist Alternative Needed

The rising cost of living is hurting most Canadians. The health system is in deep crisis. Climate change is getting worse, with new disasters every year. A major recession may be coming soon.

Yet the leaders of the workers’ movement — the unions and the NDP — are remarkably passive. Socialist Alternative, in contrast, argues for building a powerful movement with clear demands and actions to win a better world for working people.

Canada is awash with money. In the two years after March 2020 the wealth of Canada’s 59 billionaires increased by $111 billion. Corporate profits are higher than at any time in history, at 17.4 percent of GDP compared to the historic average of around 10 percent. There is money to tackle the many problems.

We need economic democracy where workers decide on pay and conditions, the allocation of jobs, and the number and types of quality homes that are built. Canadian workers have the skill and knowledge to build a great health system and tackle climate change.

The key is taking the wealth of society into democratic public ownership, ending the rule of the tiny minority. We are actively building a Socialist Alternative.